omaha nebraska sales tax rate 2020

2019 Net Taxable Sales. The December 2020 total local sales tax rate was also 7.

Where S My Nebraska State Tax Refund Taxact Blog

Tax rates provided by Avalara are updated monthly.

. The Omaha Nebraska general sales tax rate is 55Depending on the zipcode the sales tax rate of Omaha may vary from 55 to 7 Every 2020 combined rates mentioned above are the results of Nebraska state rate 55 the Omaha tax rate 0 to 15. The state sales tax in Nebraska is 550. Nebraska has a 55 statewide sales tax rate but also has 295.

The state capitol Omaha has a. The current total local sales tax rate in Columbus NE is 7000. With local taxes the total sales tax rate is between 5500 and 8000.

Current Local Sales and Use Tax Rates and Other Sales and Use Tax Information. There is no applicable city tax. 536 rows Nebraska Sales Tax55.

The minimum combined 2022 sales tax rate for Omaha Nebraska is. The Omaha Nebraska sales tax is 700 consisting of 550 Nebraska state sales tax and 150 Omaha local sales taxesThe local sales tax consists of a 150 city sales tax. Omaha in Nebraska has a tax rate of 7 for 2022 this includes the Nebraska Sales Tax Rate of 55 and Local Sales Tax Rates in Omaha totaling 15.

This rate includes any state county city and local sales taxes. Nebraska City 20 75 075 16-339 33705 Nehawka 10 65 065 240-340 33740. The latest sales tax rate for Omaha GA.

There is no applicable county tax or special tax. The Nebraska sales tax rate is currently. Omaha collects a 15 local sales.

There are no changes to local sales and use tax rates that are effective January 1 2022. 2020 rates included for use while preparing your income tax deduction. ICalculator US Excellent Free Online Calculators for Personal and Business use.

2020 rates included for use while preparing your income tax deduction. There is no applicable special tax. You can print a 825 sales tax table here.

A 5 percent sales tax is imposed by Nebraska on all sales and use. The 775 sales tax rate in Omaha consists of 65 Arkansas state sales tax and 125 Boone County sales tax. There are a total of 334 local tax jurisdictions across the.

Look up 2022 sales tax rates for Nemaha County Nebraska. The Nebraska state sales and use tax rate is 55 055. Local Sales and Use Tax Rates Effective January 1 2020.

The latest sales tax rate for Columbus NE. The Nebraska state sales tax rate is 55 and the average NE sales tax after local surtaxes is 68. Effective April 1 2022 the city of Arapahoe will increase its rate from 1 to 15.

The Total Rate column has an for those municipalities. Notification to Permitholders of Changes in Local Sales and Use Tax Rates Effective July 1 2022 Updated 03032022 There are no changes to local sales and use tax rates that are effective July 1 2022. The 8 sales tax rate in Omaha consists of 4 Georgia state sales tax 3 Stewart County sales tax and 1 Special tax.

The December 2020 total local sales tax rate was also 7000. Nebraska has recent rate changes Thu Jul 01 2021. See the County Sales and Use Tax Rates section at the end of this listing for information on how these counties are treated differently.

The 7 sales tax rate in Omaha consists of 55 Nebraska state sales tax and 15 Omaha tax. You can print a 8 sales tax table here. 2020 Sales Tax 55.

This rate includes any state county city and local sales taxes. The Omaha sales tax rate is. The Omaha Sales Tax is collected by the merchant on all qualifying sales made within Omaha.

You can print a 7 sales tax table here. Counties and cities in Nebraska are allowed to charge an additional local sales tax on top of the state sales tax. Omaha collects the maximum legal local sales tax.

The Nebraska state sales and use tax rate is 55 055. For tax rates in other cities see Texas sales taxes by city and county. Nebraska has state sales tax of 55 and allows local governments to collect a local option sales tax of up to 2.

For tax rates in other cities see Georgia sales taxes by city and county. The December 2020 total local sales tax rate was also 8000. Omaha collects the maximum legal local sales tax.

There is no applicable city tax or special tax. 30 rows The state sales tax rate in Nebraska is 5500. 2020 Net Taxable Sales.

2022 Cost of Living Calculator for Taxes. For tax rates in other cities see Nebraska sales taxes by city and county. This is the total of state county and city sales tax rates.

Average Sales Tax With Local. The 825 sales tax rate in Omaha consists of 625 Texas state sales tax 05 Morris County sales tax and 15 Omaha tax. There are no changes to local sales and use tax rates that are effective July 1 2022.

Groceries are exempt from the Omaha and Nebraska state sales taxes. The County sales tax rate is. Columbus NE Sales Tax Rate.

The current total local sales tax rate in Omaha NE is 7000. Select the Nebraska city from the list of popular cities. 2019 Sales Tax 55.

How High Are Cell Phone Taxes In Your State Tax Foundation

States With Highest And Lowest Sales Tax Rates

Sales Taxes In The United States Wikiwand

Sales Taxes In The United States Wikiwand

General Fund Receipts Nebraska Department Of Revenue

Which Cities And States Have The Highest Sales Tax Rates Taxjar

Removing Barriers In Nebraska Part Three How Our Taxes And Spending Compare

Nebraska Income Tax Calculator Smartasset

Sales Taxes In The United States Wikiwand

New Ag Census Shows Disparities In Property Taxes By State

How Does Sales Tax Work On Fitness Memberships Taxjar

Cell Phone Tax Wireless Taxes Fees Tax Foundation

Tax Foundation Proposed Tax Rate Increases Undo Impact Of Property Tax Cuts

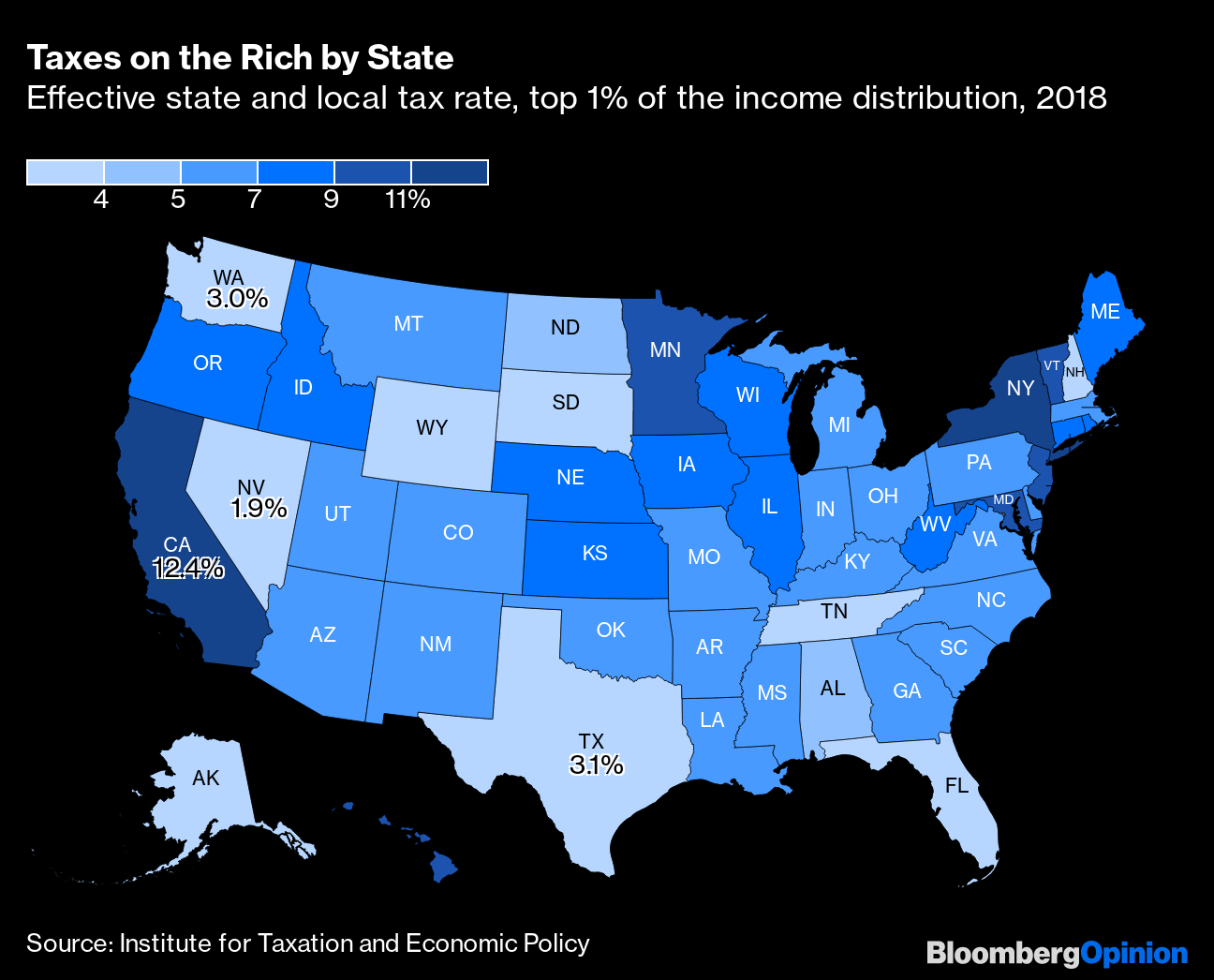

Wait California Has Lower Middle Class Taxes Than Texas Bloomberg

States With Highest And Lowest Sales Tax Rates